Notes 2016

GENERAL INFORMATION ON ACCOUNTING POLICIES

The Münchener Hypothekenbank eG annual financial statement as of December 31, 2016 was prepared in accordance with the provisions of the German Commercial Code (HGB), in conjunction with the accounting regulation for banks and financial service institutions (RechKredV), and in accordance with the rules contained in the Cooperatives Act (GenG) and the Pfandbrief Act (PfandBG).

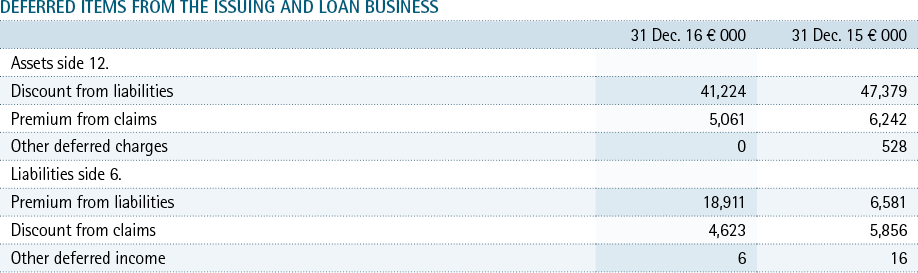

All claims are stated at nominal amounts in accordance with Art. 340e (2) of the German Commercial Code. The difference between the amounts disbursed and the nominal amount is shown under deferred items. All identifiable individual credit risks are covered by specific value adjustments and provisions set up against claims for repayment of principal and payment of interest. Contingent risks are covered by general value adjustments. In addition, contingency reserves were formed pursuant to Art. 340f of the German Commercial Code.

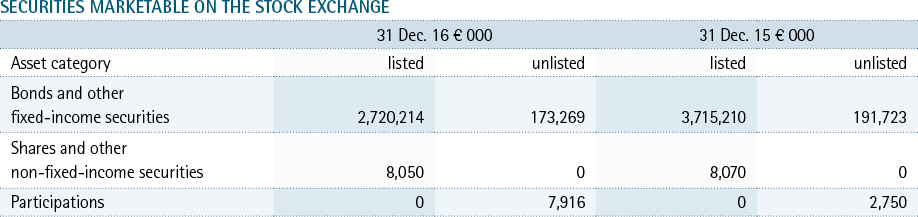

Securities held in the liquidity portfolio are strictly valued at the lower of cost or market principle. The present value corresponds to the current exchange or market price.

Securities held as fixed assets, which were mainly acquired as cover for Public Pfandbriefe and for other coverage purposes, are valued at their cost of purchase. Discounts and premiums are recognised as interest income or expense over the residual life of the securities. Securities associated with swap agreements are valued together with these agreements as a single item. To the extent that derivatives are used to hedge risks they are not valued individually. As in the previous year, securities held as fixed assets in the business year, and which were not subject to a sustained decrease in value, are valued in accordance with the modified lower of cost or market principle. In cases involving securities treated as fixed assets where a permanent decrease in value is anticipated, the write-down to the fair value takes place on the balance sheet date.

Borrowed securities do not appear on the balance sheet.

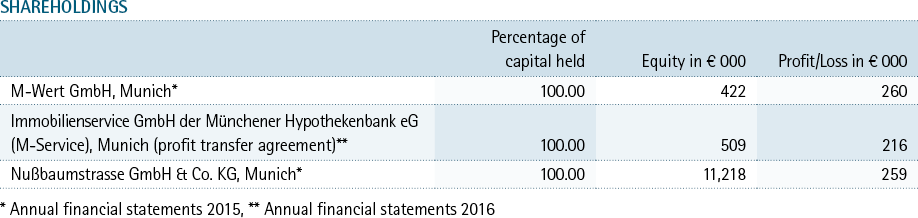

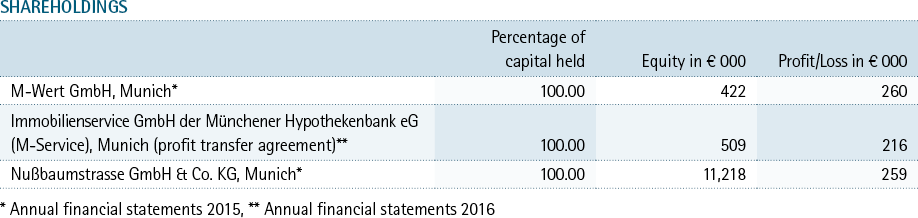

In accordance with the rules pertaining to the valuation of fixed assets, participations and holdings in affiliated companies are valued at their cost of purchase. Depreciation is taken on those assets where the reduction in value is expected to be long-term. Participations of current assets are shown under the item “Other assets”.

Intangible assets and tangible assets are valued at cost or production costs less accumulated depreciation. Planned depreciation was taken in accordance with normal useful lifetimes. Minor value assets were treated in accordance with tax rules.

Existing deferred taxes arising due to temporary differences between values calculated for trading and tax purposes are cleared. A backlog of deferred tax assets is not recorded in the balance sheet.

Liabilities are shown at their settlement value. Zero bonds are carried in the accounts at the issuing price plus earned interest based on the yield at the time of purchase in accordance with the issuing conditions. The difference between the nominal amount of liabilities and the amount disbursed is shown under deferred items. Based on the principles of prudent business practice, provisions have been made for uncertain liabilities in the amount of settlement value of these liabilities. Provisions with a remaining term of more than one year were discounted using the commensurate average rate of market interest rates. Provisions made for pension obligations are calculated based on the Projected Unit Credit Method, a discount rate of 4.01 percent and a 2.5 percent rate of salary growth, as well as a 2.0 percent rate of pension growth. The calculation is made on the basis of “Guideline tables 2005 G” prepared by Prof. Klaus Heubeck. In accordance with the terms of Art. 253 (2) of the German Commercial Code the average market rate of interest of the last 10 business years (previous year: last 7 business years ) is used for discount purposes with an assumed remaining term to maturity of 15 years.

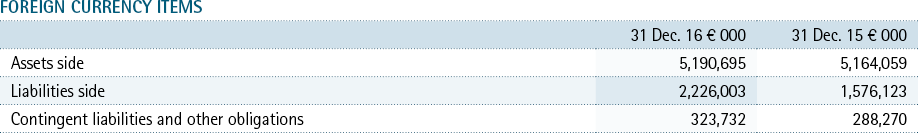

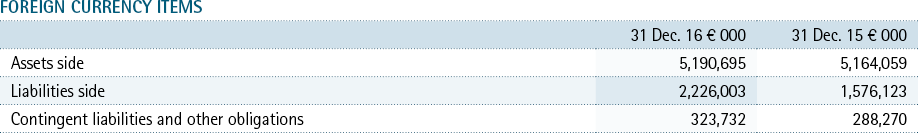

Per the terms of Art. 256a of the German Commercial Code, monetary assets and liabilities denoted in foreign currencies are translated at the European Central Bank’s exchange rate valid on the balance sheet date. Income realised from the translation of particularly covered foreign currency positions is carried under net interest income. Costs and income are valued at the individual daily exchange rate.

Negative interest on financial assets or financial liabilities has been deducted from the related interest income items or interest expense items shown on the Income Statement.

NOTES TO THE BALANCE SHEET INCOME STATEMENT

TRADING BOOK

As at 31.12.2016 the portfolio contained no financial instruments used in the trading book. During the year under review no changes were made to the Bank’s internal criteria for including financial instruments in the trading portfolio.

As of the balance sheet date there was no indication that the present value of the Bank’s participations and capital holdings at cooperatives, holdings in affiliated companies, as well as the value of shares and other non-fixed-income securities was less than their book values. The item “Bonds and other fixed-income securities” includes securities with a book value of € 1,086,213 (thousand) (previous year € 1,890,324 (thousand)) exceeding the present value of € 1,075,049 (thousand) (previous year € 1,868,108 (thousand)). To the extent that these securities are associated with a swap transaction, they are valued together with the transaction as a single item.

Securities held as fixed assets in the business year, and which are not expected to be subject to a permanent impairment in value, are valued in accordance with the moderated lower of cost or market principle. In light of our intention to hold these securities until they mature, we generally assume that market price-related decreases in value will not become effective and that securities will be repaid in full at their nominal value at maturity.

TANGIBLE ASSETS

The portion of the total value attributable to the land and buildings used by the Bank is € 58,772 (thousand) (previous year € 59,730 (thousand)), and of plant and office equipment € 2,340 (thousand) (previous year € 1,831 (thousand)).

OTHER ASSETS

The item “Other assets” includes deferred items of € 36,222 (thousand) related to the derivative business, and € 46,032 (thousand) in commissions for mortgage loans that will be paid after the balance sheet date. In addition, this item also includes a participation held for sale recorded at € 6,326 (thousand) and tax claims of € 3,539 (thousand). Furthermore, this item also includes € 5,732 (thousand) in cash collateral pledged within the framework of the banking levy.

DEFERRED TAXES

Deferred tax liabilities mainly result from the low valuation of bank buildings taken for tax purposes. Deferred tax assets arise from provisions made for pensions, and the different methods used to value premiums from swap options that were exercised. The remaining backlog of deferred tax assets arising after clearing is not recorded in the balance sheet.

ASSETS PLEDGED TO SECURE LIABILITIES

Within the framework of open market deals with the European Central Bank, securities valued at € 500,000 (thousand) (previous year € 691,000 (thousand)) were pledged as collateral to secure the same amount of liabilities. The book value of the pledged assets (genuine repurchase agreements) was € 0 (previous year € 22,580 (thousand)). Within the framework of security arrangements for derivative transactions, cash collateral of € 2,231,773 (thousand) (previous year € 2,407,190 (thousand)) was provided. Securities valued at € 14,588 (thousand) (previous year € 14,068 (thousand)) were pledged to secure pension obligations and requirements of the partial retirement model for older employees. Securities valued at € 18,000 (thousand) (previous year € 30,000 (thousand)) were pledged to secure financial aid obligations within the framework of a Contractual Trust Arrangement (CTA). Pursuant to Art. 12 para. 5 of the Restructuring Fund Act (Restrukturierungsfondsgesetz – RStruktFG) € 5,732 (thousand) in cash collateral has been pledged.

OTHER LIABILITIES

The item “Other liabilities” consists of € 337,210 (thousand) for deferred items and adjustment items for valuation of foreign currency items, and € 65,752 (thousand) related to derivative transactions as well as, above all, liabilities valued at € 2,548 (thousand) for accrued interest related to silent participations.

PROVISIONS

The period under review used for defining the average market rate of interest used to calculate provisions for pension obligations was increased from 7 to 10 years. The conversion resulted in a positive contribution to income of € 2,789 (thousand), which is barred from being distributed.

SUBORDINATED LIABILITIES

Subordinated liabilities incurred interest expenses of € 8,704 (thousand) (previous year € 8,720 (thousand)). Subordinated liabilities which individually exceed 10 percent of the overall statement amount to:

The instruments comply with the provisions of Art. 63 of the Capital Requirements Regulation (CRR).

Premature repayment obligations are excluded in all cases. The conversion of these funds into capital or other forms of debt has not been agreed upon nor is foreseen. Reporting on the balance sheet is shown at nominal value.

PROFIT-PARTICIPATION CAPITAL

Profit-participation capital in the nominal amount of € 6,136 (thousand) (previous year € 6,136 (thousand)) includes four profit-participation certificates bearing fixed rates of interest. It fulfils the requirements of Art. 63 CRR with a value of € 6,136 (thousand) (previous year € 6,136 (thousand)).

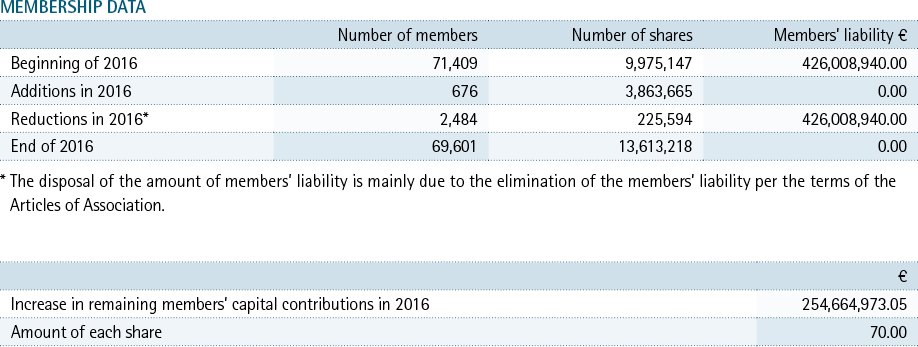

MEMBERS’ CAPITAL CONTRIBUTIONS

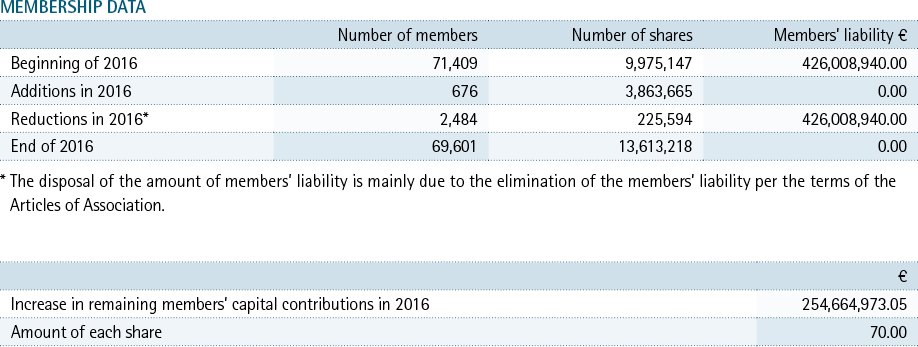

Members’ capital contributions disclosed under capital and reserves item 11aa) consisted of:

SILENT PARTICIPATIONS

Fifteen silent participations in the amount of € 30,749 thousand (previous year € 170,749 (thousand)) bearing fixed rates of interest incurred expenses of € 5,643 (thousand) (previous year € 16,418 (thousand)).

The increase in the assessment period used for defining the average discount rate from 7 to 10 years resulted in a positive contribution to income of 2,789 (thousand), which is barred from being distributed and is included under the item “Other revenue reserves”.

OTHER OBLIGATIONS

The irrevocable loan commitments contained in this item consist almost solely of mortgage loan commitments made to customers. It is anticipated that the irrevocable loan commitments will be drawn down. Against the background of the ongoing monitoring of loans, the probable need to create provisions for risks related to contingent obligations and other obligations is viewed as minor.

OTHER OPERATING EXPENSES

This item contains expenses arising from adding interest effects of € 1,643 (thousand) (previous year € 4,239 (thousand)) for established provisions.

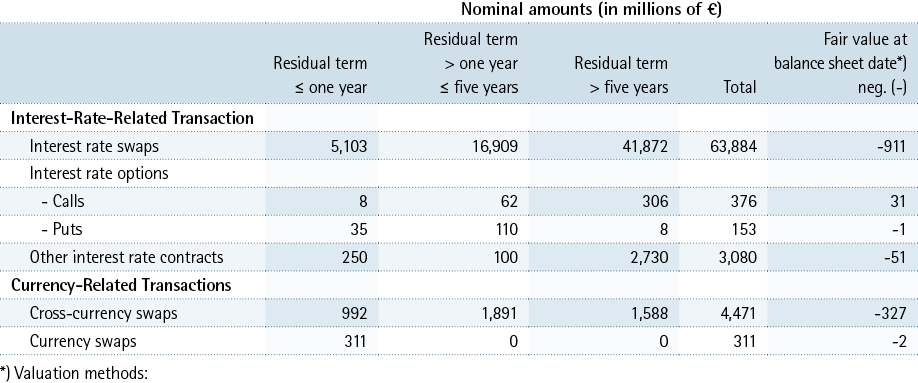

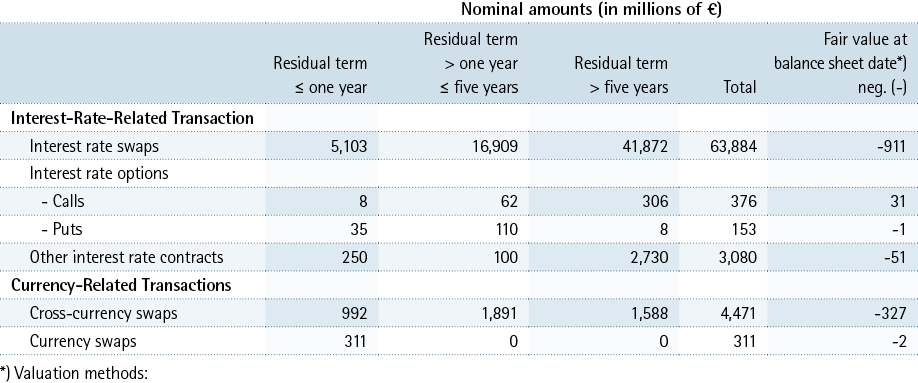

FORWARD TRADES AND DERIVATIVES

The following derivative transactions were made to hedge swings in interest rates or hedge against exchange rate risks. These figures do not include derivatives embedded in underlying basic transactions stated on the balance sheet.

Interest rate swaps are valued using the present value method based on the current interest rate curve at the balance sheet date. In doing so the cash flows are discounted using market interest rates appropriate for the related risks and remaining terms to maturity, interest that has been accrued but not yet paid is not taken into consideration. This approach is known as “clean price” valuation.

The value of options is calculated using option price models and generally accepted basic assumptions. In general, the particular value of an option is calculated using the price of the underlying value, its volatility, the agreed strike price, a risk-free interest rate, and the remaining term to the expiration date of the option.

The derivative financial instruments noted involve premiums stemming from option trades in the amount of € 24.4 million (previous year € 2.9 million) which are carried under the balance sheet item “Other assets”.

Interest attributable to derivative deals is carried under the balance sheet items “Claims on banks” with € 348.2 million (previous year € 363.0 million) and “Liabilities to banks” with € 399.2 million (previous year € 409.0 million). The accrual of compensatory payments made is entered under “Other assets” with € 11.8 million (previous year € 9.3 million); the accrual of compensatory payments received is entered under “Other liabilities” with € 65.8 million (previous year € 86.1 million).

Compensatory items in the amount of € 337.2 million (previous year € 372.8 million) related to the valuation of foreign currency swaps are carried under the balance sheet item “Other liabilities”.

The counterparties are primarily banks and insurance companies located in OECD countries, as well as separate funds under public law in Germany.

Hedging arrangements were made to reduce credit risks associated with these contracts. Within the framework of these arrangements collateral was provided for the net claims/liabilities arising after the positions were netted.

In the context of the Bank’s hedging positions, € 2,565 million (previous year € 3,258 million) in balance sheet hedging positions were designated in accounting to hedge interest rate risks associated with securities carried on the balance sheet under “Bonds and other fixed-income securities”. It may be assumed that the effectiveness of the hedging positions will remain unchanged over the entire term of the transaction as conditions of the securities correspond to those of the hedging derivatives. Offsetting changes in value are not shown in the balance sheet; uncovered risks are treated in accordance with standard valuation principles. The total amount of offsetting value changes for all valuation units amounted to € 234 million.

Interest-based finance instruments carried in the banking book are valued without losses within the framework of an overall valuation, whereby the interest rate driven present values are compared to the book values and then deducted from the positive surplus of the risk and portfolio management expenses. In the event of a negative result a provision for contingent risks has to be made.

A related provision did not have to be made based on the results of the calculation made on 31.12.2016.

As on the date of record the portfolio contained no derivatives used in the trading book.

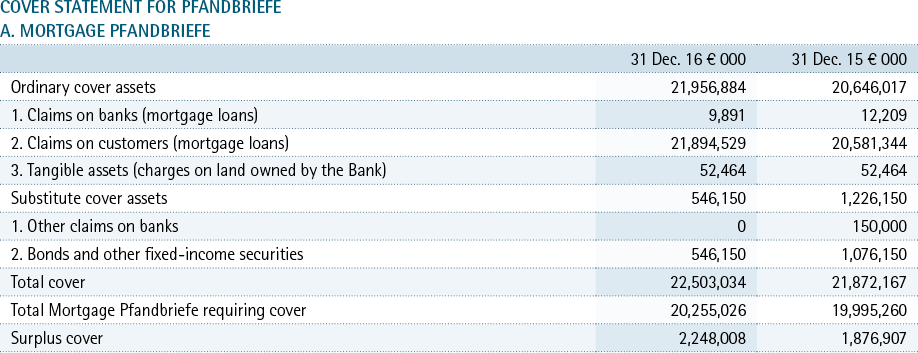

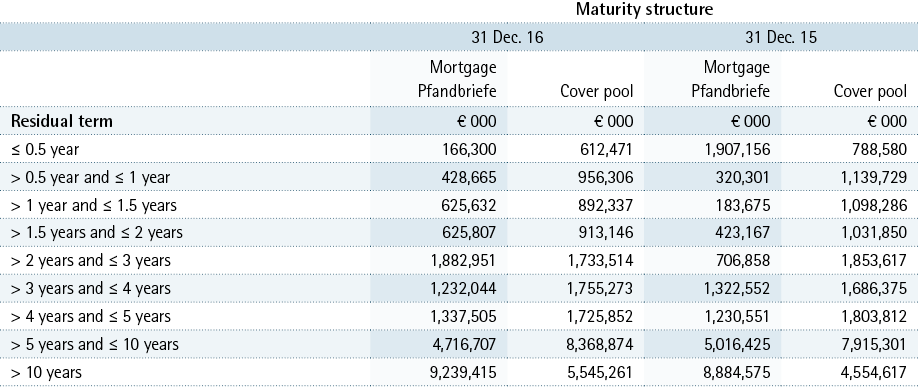

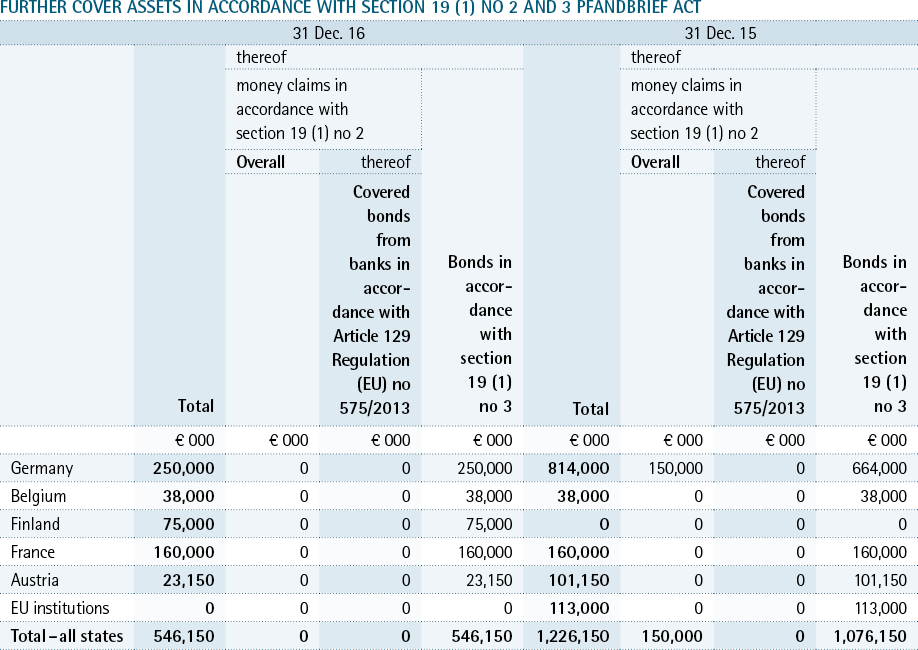

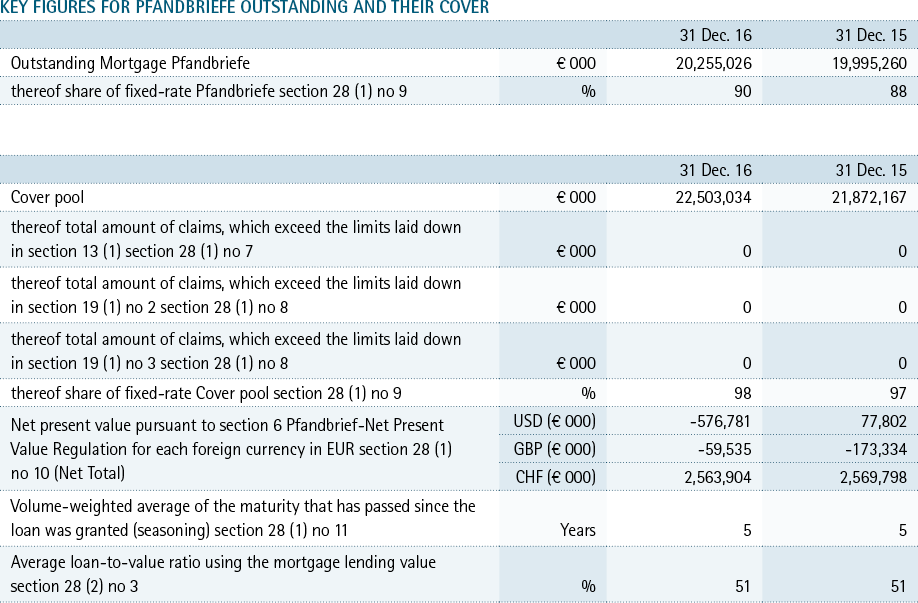

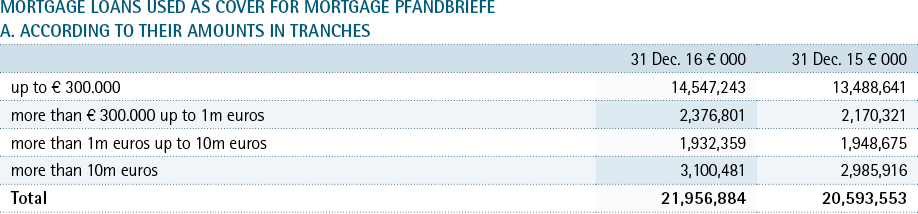

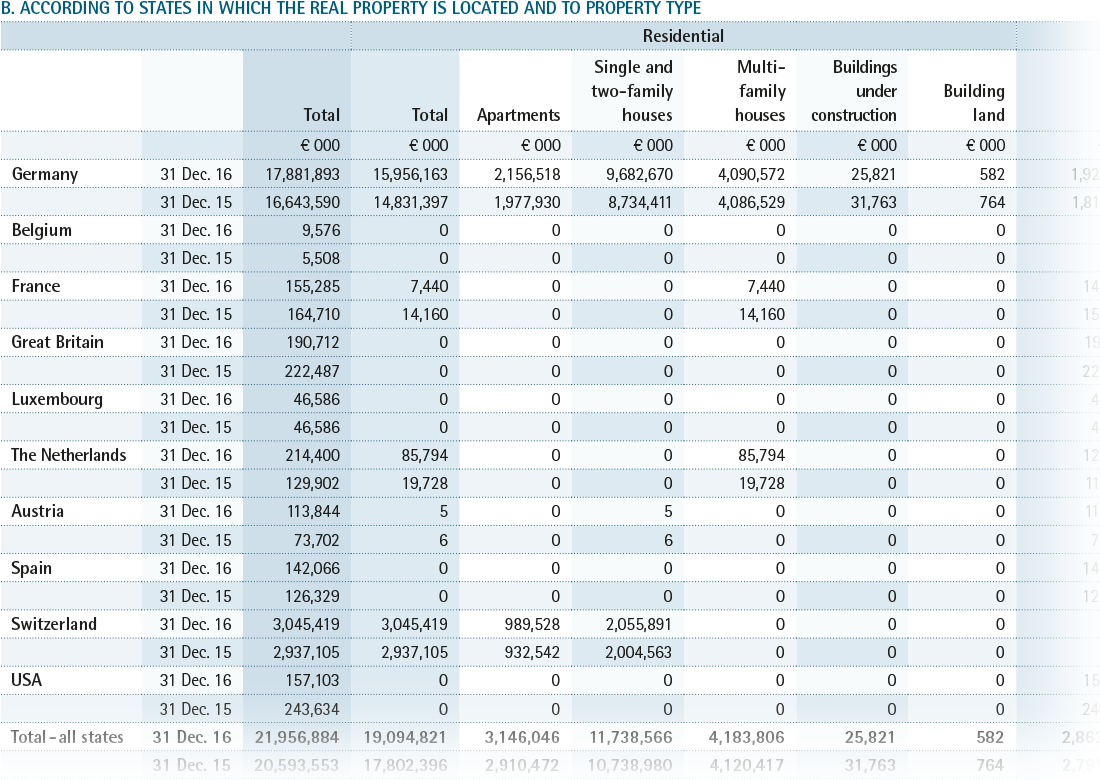

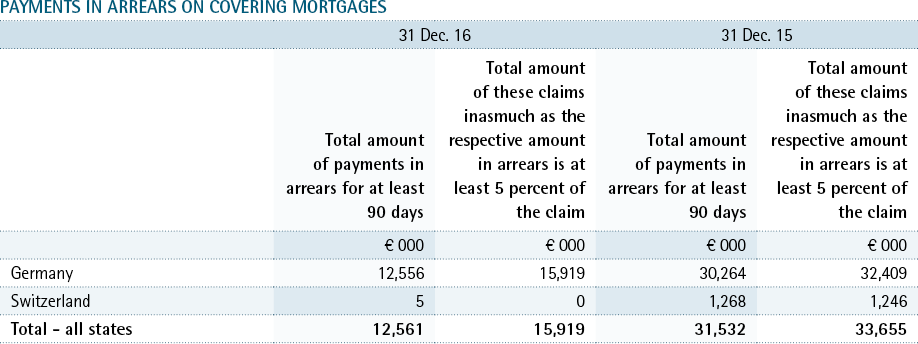

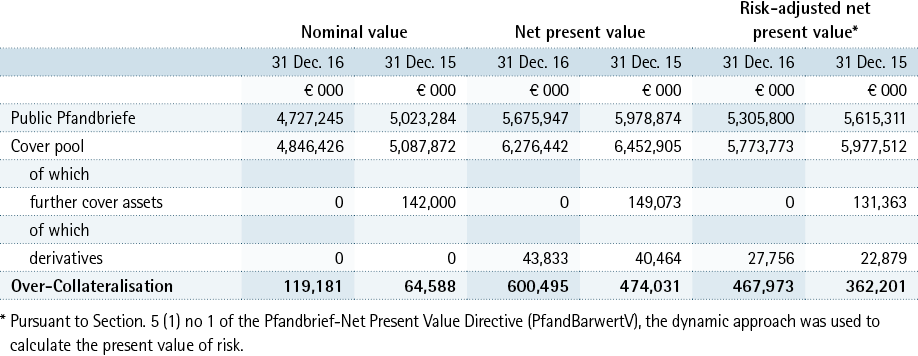

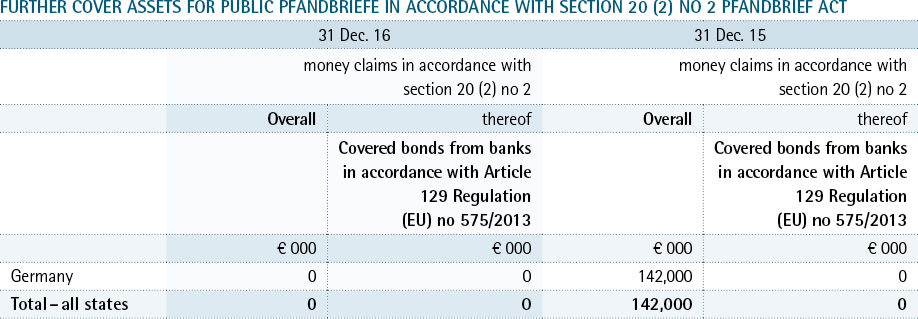

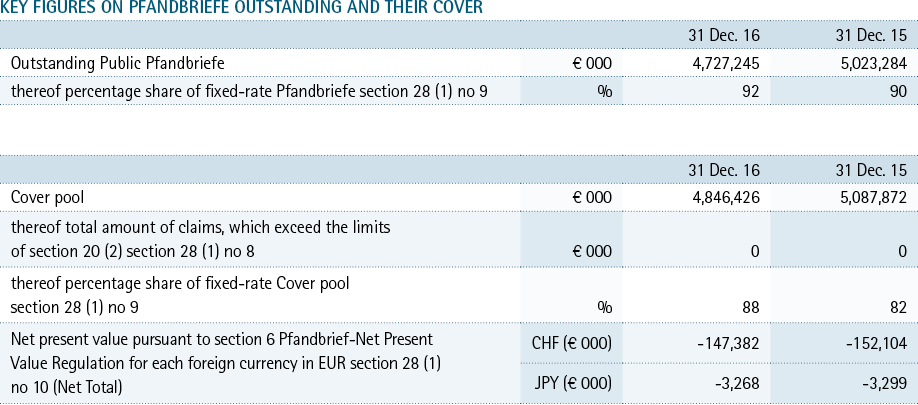

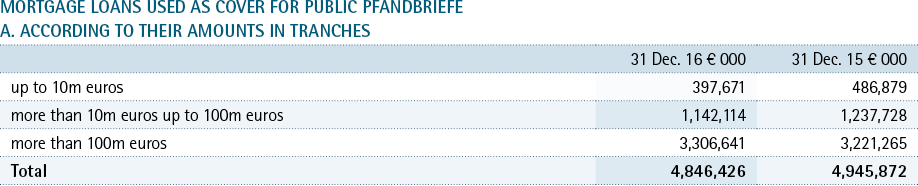

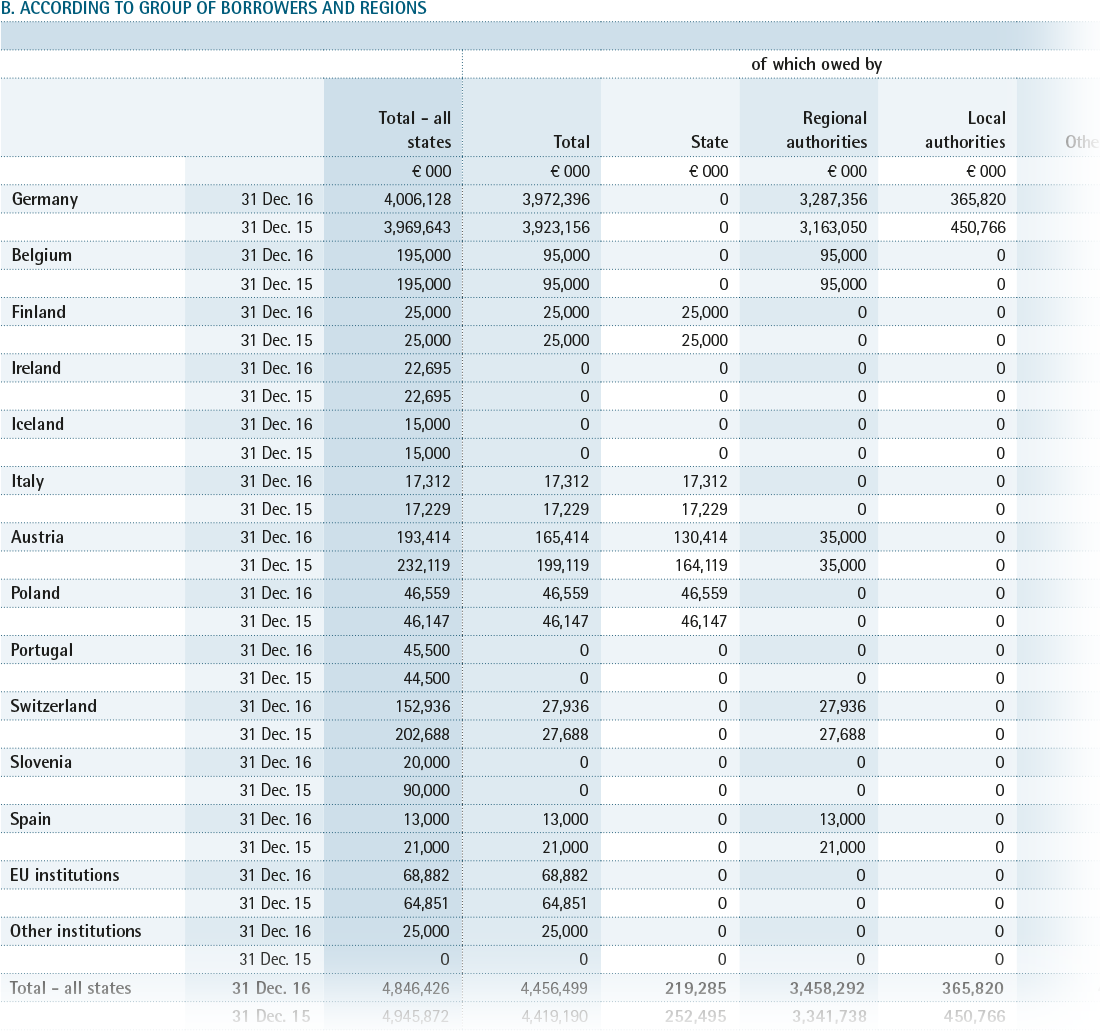

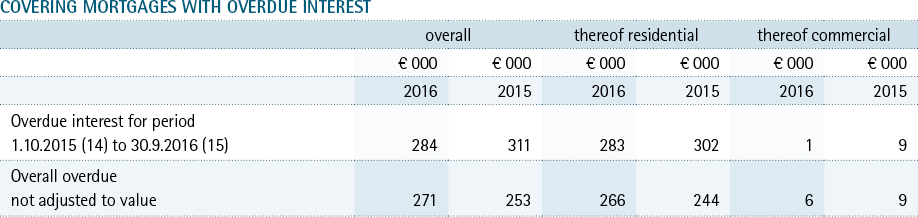

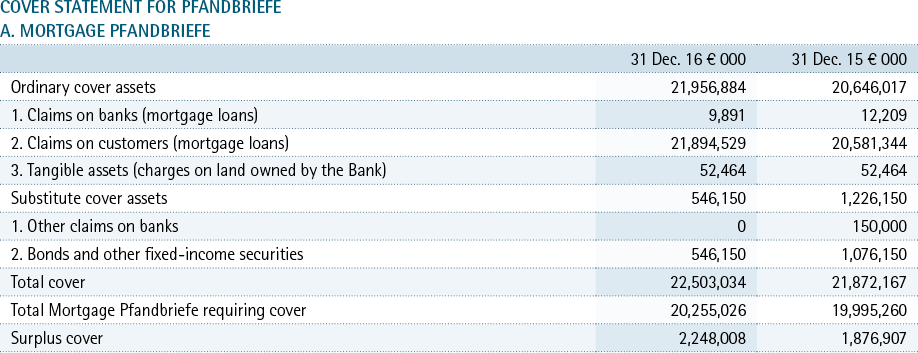

PUBLICATION IN ACCORDANCE WITH SECTION 28 PFANDBRIEF ACT

PUBLIC PFANDBRIEFE OUTSTANDING AND THEIR COVER

Discounts based on the vdp credit quality differentiation model were taken into consideration in calculating the cover pool.

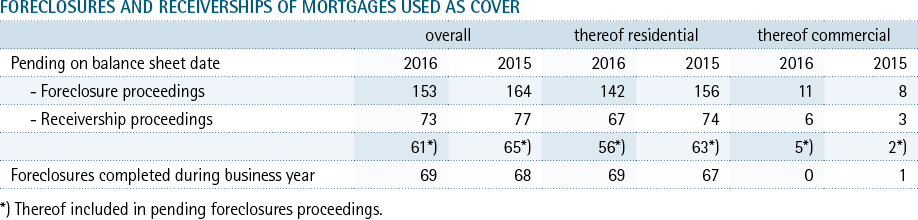

During the year under review no objects had to be taken over to salvage our claims.

OTHER DISCLOSURES

SPECIAL DISCLOSURE REQUIREMENTS

Pursuant to section 8 CRR (Articles 435 to 455), Münchener Hypothekenbank publishes information it is required to disclose in a separate disclosure report in the Federal Gazette (Bundesanzeiger), as well as on the Bank’s homepage.

Pursuant to section 26a (1) (4) of the German Banking Act (KWG), the quotient of net income and total assets is equal to 0.0829 percent.

PROPOSED APPROPRIATION OF DISTRIBUTABLE INCOME

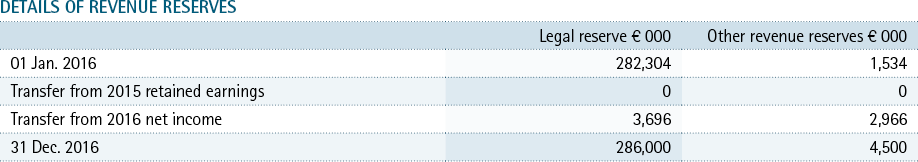

Net income for the year amounted to € 31,936,484.76. An advance allocation of € 3,695,534.89 to legal reserves and another allocation of € 2,966,124.36 to other revenue reserves is presented in the current annual financial statements.

A dividend distribution of 3.25 percent will be proposed at the Delegates Meeting. The remaining unappropriated profit for the year – including profit carried forward from the previous year – amounting to € 25,446,268.29 should therefore be allocated as follows:

3.25 percent dividend € 25,245,400.00

Carried forward to new year € 200,868.29

REPORT ON EVENTS AFTER THE BALANCE SHEET DATE

Events of material importance did not take place after the balance sheet date.

COMPANY

Münchener Hypothekenbank eG

Karl-Scharnagl-Ring 10 | 80539 Munich

Register of cooperatives of the District Court of Munich

Gen.-Reg 396

BODIES

SUPERVISORY BOARD

Konrad Irtel … Griesstätt (until 23.04.2016)

Bank director (ret.)

Chairman of the Supervisory Board

Wolfhard Binder … Grafing

Chairman of the Board of Management of

Raiffeisen-Volksbank Ebersberg eG

Chairman of the Supervisory Board (as of 23.04.2016)

HSH Albrecht Prince of Oettingen-Spielberg … Oettingen (until 23.04.2016)

Deputy Chairman of the Supervisory Board

Dr. Hermann Starnecker … Marktoberdorf (as of 23.04.2016)

Spokesman of the Board of Management of

VR Bank Kaufbeuren-Ostallgäu eG

Deputy Chairman of the Supervisory Board

Heinz Fohrer … Esslingen

Member of the Board of Management of

Volksbank Esslingen eG

Barbara von Grafenstein … Munich (as of 12.07.2016)

Employee representative

Jürgen Hölscher … Lingen

Member of the Board of Management of

Volksbank Lingen eG

Rainer Jenniches … Bonn

Chairman of the Board of Management of

VR-Bank Bonn eG

Reimund Käsbauer … Munich (as of 12.07.2016)

Employee representative

Dr. Peter Ramsauer … Traunwalchen

Master Craftsman (Miller)

Michael Schäffler … Munich (as of 12.07.2016)

Employee representative

Gregor Scheller … Forchheim

Chairman of the Board of Management of

Volksbank Forchheim eG

Kai Schubert … Trittau

Member of the Board of Management of

Raiffeisenbank Südstormarn Mölln eG

Frank Wolf-Kunz … Munich (as of 12.07.2016)

Employee representative

BOARD OF MANAGEMENT

Dr. Louis Hagen

Spokesman (until 14.03.2016), Chairman (as of 14.03.2016)

Bernhard Heinlein

Michael Jung

Mandates

Dr. Louis Hagen

Bau- und Land-Entwicklungsgesellschaft Bayern GmbH

Member of the Supervisory Board (until 06.06.2016)

HypZert GmbH

Chairman of the Supervisory Board (until 31.12.2016)

KfW

Member of the Board of Supervisory Directors (as of 01.01.2017)

As of the balance sheet date loans to members of the Supervisory Board amounted to € 1,095 (thousand) (previous year € 875 (thousand)). As in the previous year the lending portfolio did not include any loans made to members of the Board of Management. Pension provisions of € 16,745 (thousand) (previous year € 18,029 (thousand)) were made for former members of the Board of Management. Total remuneration received by the members of the Board of Management during the year under review amounted to € 1,785 (thousand) (previous year € 1,768 (thousand)), for members of the Supervisory Board € 302 (thousand) (previous year € 260 (thousand)). Total compensation received by the members of Advisory Committee amounted to € 54 (thousand) (previous year € 49 (thousand)). Total compensation received by former members of the Board of Management and their surviving dependants amounted to € 1,239 (thousand) (previous year € 1,264 (thousand)).

AUDITING ASSOCITATION

DGRV – Deutscher Genossenschafts- und Raiffeisenverband e. V., Berlin, Pariser Platz 3

Pursuant to Art. 53 of the Cooperatives Act, in association with Art. 340k of the German Commercial Code, total costs of € 733 (thousand), including valued added tax, (previous year € 750 (thousand)) were incurred for auditing the annual financial statements and the management report, the cooperative’s organisational structures, and for examining the Bank’s management during the year under review. Total fees of € 72 (thousand) (previous year € 61 (thousand)) were incurred for auditing the annual accounts. As in the previous year, no costs were incurred for other services during the year under review.

OTHER FINANCIAL OBLIGATIONS

Pursuant to Art. 12 para. 5 of the Restructuring Fund Act (Restrukturierungsfondsgesetz – RStruktFG) irrevocable payment obligations of € 5,732 (thousand) was recorded at the balance sheet date.

CONTINGENT LIABILITY

Our Bank is a member of the protection scheme of the National Association of German Cooperative Banks (Sicherungseinrichtung des Bundesverbandes der Deutschen Volksbanken und Raiffeisenbanken e.V.). Per the statutes of the protection scheme we have issued a guarantee to the National Association of German Cooperative Banks. As a result, we have a contingent liability of € 17,144 (thousand). In addition, persuant to Article 7 of the Accession and Declaration of Commitment to the bank-related protection scheme of the BVR Institutssicherung GmbH (BVR-ISG), a premium guarantee is in force. This pertains to special contributions and special payments in the event of insufficient financial resources in order to pay for damages of depositors of one of the CRR credit institutions belonging to the protection scheme in the event of a compensation case, as well as to meet refunding obligations pursuant to cover measures.

Munich, 31 January, 2017

MÜNCHENER HYPOTHEKENBANK eG

The Board of Management

| Dr. Louis Hagen |

Bernhard Heinlein |

Michael Jung |

| |

|

|