Risik report

COUNTERPARTY RISK

Counterparty risk (credit risk) is of major importance for MünchenerHyp. Counterparty risk refers to the danger that counterparties may delay their payment obligations to the Bank, only make partial payments or even default.

The Credit Handbook presents the competencies and procedural requirements of the units involved in lending, as well as the approved credit products. The business and risk strategy contains additional explanations pertaining to sub-strategies regarding target customers and target markets, as well as definitions for measuring and controlling credit risks at the individual deal and portfolio levels. A procedure based on the credit value-at-risk (Credit-VaR) is used to determine lending limits. The individual contribution of every borrower (aggregate debtor or limit group as appropriate) – the Marginal Credit-VaR – to the Bank’s total credit risk is limited. Furthermore, limits are also set for each country to ensure adequate regional diversification.

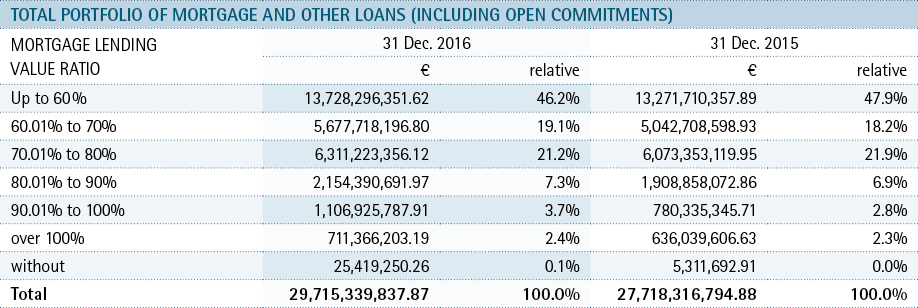

We take care to ensure that the vast majority of our mortgage business activities consists of top tier loans with moderate loan-to-value ratios. The current breakdown based on loan-to-value ratios is as follows:

The management of credit risks begins with the selection of the target business when drafting the terms of the loan, using risk-cost functions that are regularly reviewed. A variety of rating or scoring procedures are used depending on the type and risk content of the transaction.

In addition, a computer-based early warning system is used to identify risks on a timely basis.

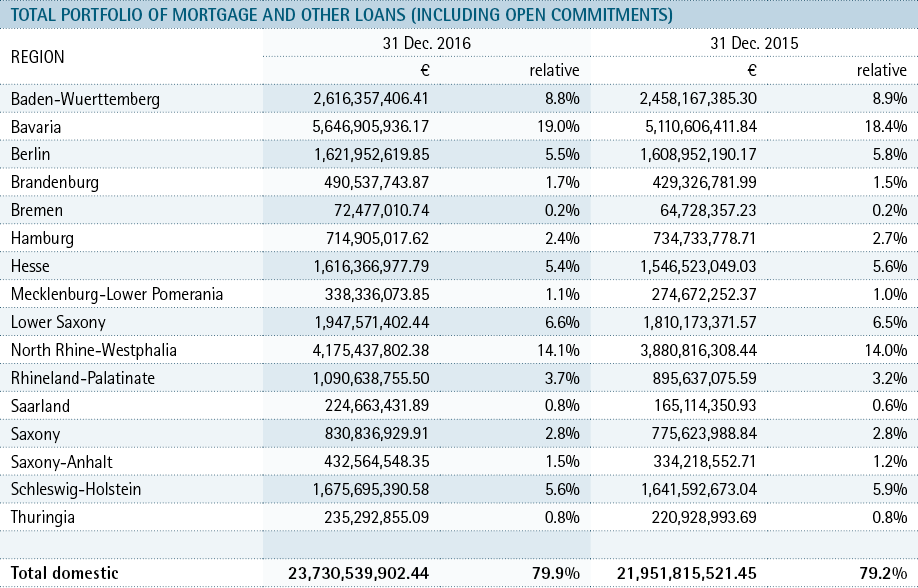

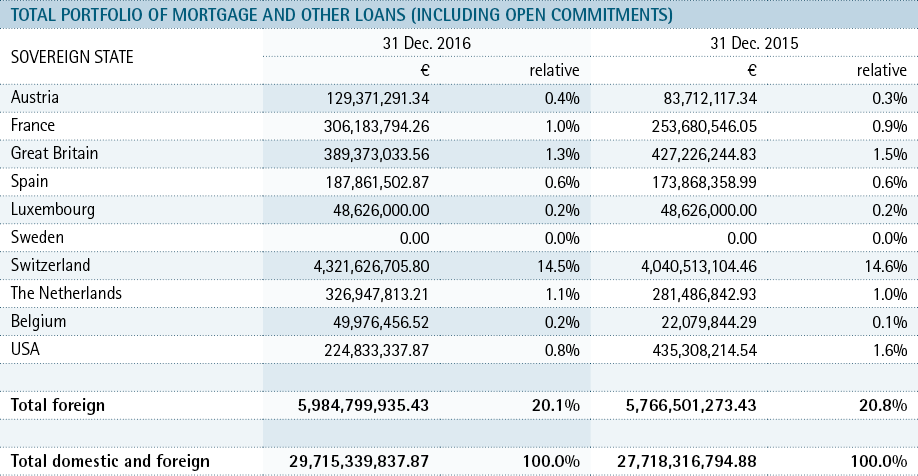

Property financing contains a broadly diversified portfolio of loans with emphasis on residential property financing and a credit approval process that has proven its value over many years as reflected in a portfolio with a low level of credit risk. Our lending business with public sector borrowers and banks is primarily focused on central and regional governments, regional and local authorities, and west European banks. It is a portfolio with little credit risk. Regional emphasis is on Germany or Western Europe respectively. Our objective for this portfolio is to further reduce its volume due to reasons such as the introduction of the leverage ratio. Highly liquid sovereign bonds and other very creditworthy securities will, however, continue to be needed in order to meet the new liquidity requirements mandated by Basel III.

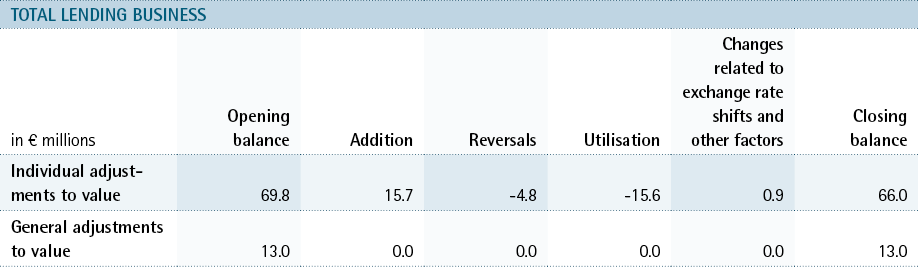

Depending on their ratings, mortgage loans are examined to determine any non-performance or other negative factors which could trigger an individual adjustment to value. Furthermore, an additional system to monitor individual adjustment to value is used by the Bank’s work-out management department, especially for the non-retail market business.

The Bank has created a general adjustment-to-value reserve as a precautionary measure to cover latent lending risks. This general adjustment to value is calculated per the terms contained in a Federal Ministry of Finance notice dated January 10, 1994.

Individual adjustments to value taken remained at a low level for our residential property financing business due to the great stability of the residential property market. This also generally applies for our commercial property financing business.

Business relationships with financial institutions are primarily based on master agreements that permit settlement of claims and liabilities (netting) vis-a-vis the other institution. In general, we also enter into security agreements. In the future we will use a so-called Central Counterparty (CCP) as the preferred basis for settling derivative trades.

The individual and general adjustments to value developed as follows in 2016: