Business Development

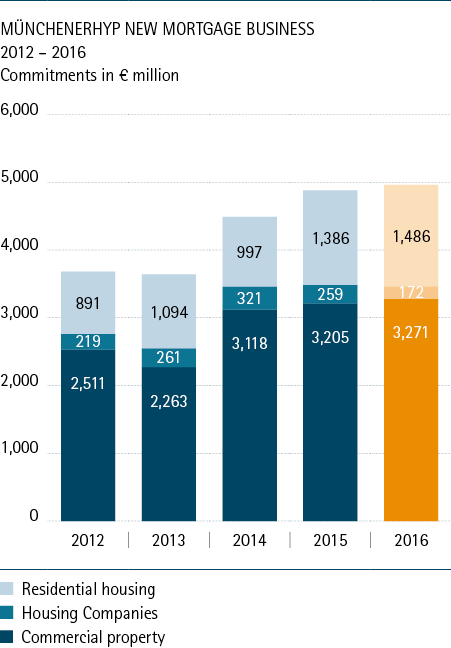

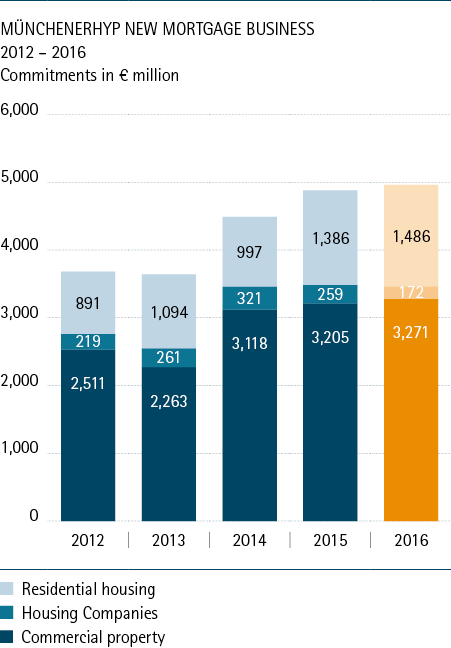

NEW MORTGAGE BUSINESS

The objective for our new mortgage business in 2016 was to once again achieve the record results we had posted in 2015. We are very pleased to report that were able to even slightly increase the volume of lending commitments we made as our new business rose by 1.6 percent to € 4.93 billion (previous year € 4.85 billion).

Private residential property lending again generated about two-thirds of our new business. In this area of business we continued to benefit from the continuing low level of interest rates, high demand for property and property financing, as well as the strong market position of our brokerage partners, especially the cooperative banks. Our volume of lending commitments rose by 2.1 percent to € 3.27 billion.

We were able, in particular, to expand the volume of business brokered by banks within the Cooperative Financial Network, as well as our business with independent providers of financial services. Our collaboration with our cooperative partner banks generated € 2.45 billion (+2.4 percent) in new business, while sales via independent providers of financial services rose to about € 400 million (+15.5 percent).

Our new business activities were not negatively affected by the complex implementation of the Directive for residential property. This was because we had converted our systems to accommodate the new conditions as early as possible thus enabling us to ensure that our production capabilities in the lending processes continued to operate smoothly without interruption. This meant that we were able to continuously deliver financing solutions to our partners at all times, which had a very favourable effect on the volume of loans brokered before and after the implementation of the Directive for residential property loans.

One of our competitive advantages is our wide range of products with numerous optional choices coupled with favourable conditions. One of them is our latest product: the MünchenerHyp Sustainability Loan, which was successful from the time it was launched in the fall of 2015. Since then this product has grown to represent almost 10 percent of our new private residential property financing business – and we were able to gain a new target group for our partner banks and our Bank: customers who place great value on sustainability.

The price wars in the property finance sector in Switzerland intensified notably as growth slowed in the Swiss residential property market. Due to these developments we strengthened our marketing activities with our collaborating partner, PostFinance, and very successfully conducted a sales campaign. As a result, we were able to record € 430 million in new lending commitments, thereby keeping our volume of new business at almost previous year’s level.

Business also developed favourably in the commercial property finance area, where we were able to slightly increase our volume of new business. We made a total of € 1.66 billion in new loans in this area.

We achieved these results against the background of the difficult environment that confronted both lenders and investors in 2016. The total volume of investments made in commercial property in most of the countries where MünchenerHyp is active declined in 2016 – along with new business opportunities for lenders. This, however, did not lead to changes in their financing offers or their willingness to make them, which intensified price competition notably.

We faced the stiffer price competition and at the same time expanded our capacities by optimising our new business procedures. As a result, we now can process a higher volume of new business enquiries while retaining the high level of quality in our analysis work. Both measures made it possible for us to slightly increase our volume of new business over the previous year’s level without altering the Bank’s approach to risk.